Fix & Flip Loans

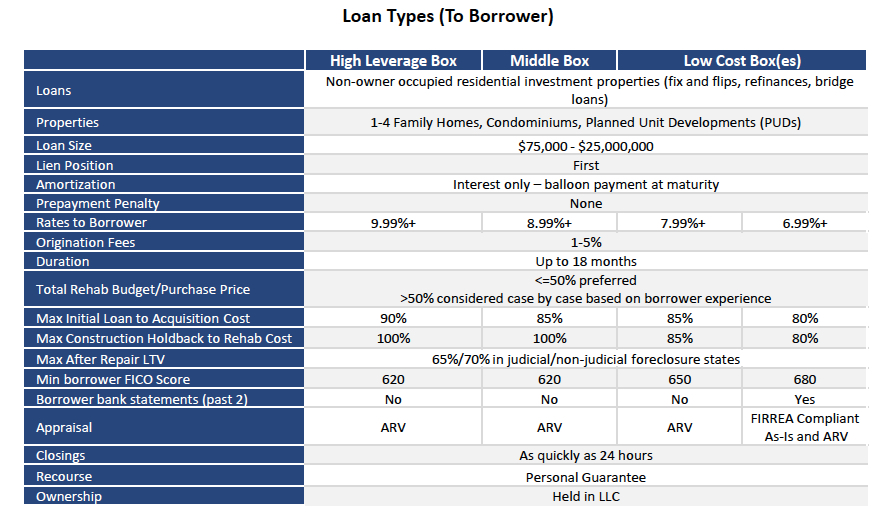

Our fix & flip financing program provides capital to investors that are looking to purchase and renovate investment properties. We only require 10% down and we will financing 100% of your renovation budget. Typically this program makes the most sense when the renovation budget is <50% of the purchase price.

Property Types: Single family homes, Condos, duplex, triplex, fourplex

Typical Transaction Terms:

- Loan Type: Senior 1st mortgage loans only

- Loan Amount:

$100,000+

- Terms: 12 months with discretionary extensions

- Amortization: Interest only

- Interest Rates: starting at 6.99%

- Initial Loan to Cost: Up to 90%

- Construction Holdback: Up to 100% of rehab budget

- After-Repair Loan to Value: Up to 70% of ARV in non-judicial foreclosure states

- Minimum Credit: 620

- Borrower Experience: 3 verified LTD flips

- Appraisal: After Repair Value Appraisal needed